Jarsy vs. Republic vs. Linqto: The Ultimate Guide to Investing in Pre-IPO Giants like SpaceX & OpenAI

The allure is undeniable: investing in giants like SpaceX, OpenAI, or Anthropic before they hit the public market, a privilege once reserved for venture capitalists and institutional players. Today, a new wave of platforms promises to democratize this exclusive club, allowing retail investors to buy a piece of the future.

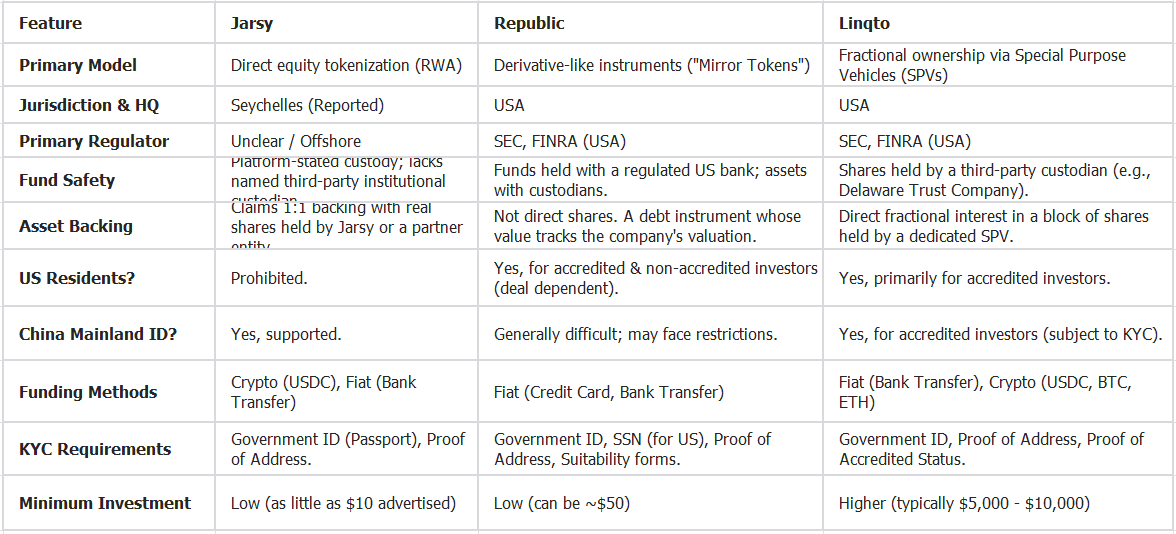

But with great opportunity comes great risk. Platforms like Jarsy, Republic, and Linqto have emerged, each with a unique model for offering access to these coveted private shares. This guide provides a deeply researched, multi-source comparison to help you navigate this exciting but complex landscape. We'll dissect their operations, regulatory standing, and the critical risks involved.

The Contenders: At a Glance

Deep Dive: How They Really Work

1. Jarsy: The Crypto-Native Tokenizer

Founding & Regulation: Jarsy is a newer entrant, operating with a global-first, crypto-native approach. Its corporate structure appears to be based in Seychelles, a common jurisdiction for crypto companies seeking regulatory flexibility. This is a critical point: it does not hold major financial licenses from regulators like the US SEC or UK's FCA. Its model is built on the transparency of the blockchain, but its legal and corporate oversight is less clear than its US-based counterparts.

Asset Model & Custody: Jarsy’s model is Real World Asset (RWA) tokenization. They claim to acquire a block of actual shares in a company like SpaceX and then mint tokens on a blockchain (e.g., Polygon) that each represent a claim on a fraction of those shares. The core question is custody: who legally holds the underlying shares? While Jarsy states they are held securely, the lack of a named, regulated, third-party institutional custodian is a significant risk factor. Investors are placing their trust directly in the Jarsy entity.

Target Audience & Listings: By accepting Chinese ID and crypto (USDC), Jarsy clearly targets a global, crypto-savvy audience excluded from the traditional US-centric system. They have listed or plan to list highly sought-after names like SpaceX, OpenAI, Anthropic, Kraken, and Stripe.

2. Republic: The Regulated Innovator

Founding & Regulation: Republic is a well-established US investment portal, registered with the SEC and a member of FINRA. Its founding team has deep roots in both the startup and legal worlds. This regulatory oversight provides a significant layer of investor protection and operational legitimacy.

Asset Model & Custody: Republic's approach is more nuanced. For assets like SpaceX, they use "Mirror Tokens" (e.g., rSPX). This is not a tokenized share. It is a derivative—specifically, a debt instrument issued by a Republic entity. Its value is designed to track the valuation of the underlying company. If there is a liquidity event (like an IPO), holders receive a cash payout equivalent to their token's value. This clever structure navigates complex securities laws but means you do not own the equity. Your investment is a claim against Republic, with fund and asset custody handled by regulated US financial institutions.

Target Audience & Listings: Republic serves both accredited and non-accredited US investors, though the best deals are often for the former. They are cautiously opening up to international investors. Their listings are broad, from early-stage startups to pre-IPO giants like SpaceX.

3. Linqto: The Traditional Model, Modernized

Founding & Regulation: Like Republic, Linqto is a US-based company registered with the SEC and a member of FINRA. It has been operating for years, building a reputation as a reliable gateway for accredited investors.

Asset Model & Custody: Linqto uses a traditional and legally robust Special Purpose Vehicle (SPV) model. They acquire a large block of shares in a company and place them into a newly created LLC (the SPV). Investors then buy membership interests in that LLC. Your ownership is a legal claim on the SPV, which in turn legally owns the shares. This is a time-tested structure in finance. Critically, the shares are held by a qualified third-party custodian like Delaware Trust Company, providing a crucial layer of separation and safety from Linqto itself.

Target Audience & Listings: Linqto's primary market is accredited investors globally (including those from mainland China who can pass KYC and accreditation checks). Their higher minimums reflect this focus. They have a strong track record, having offered access to companies like Coinbase, SoFi, and Robinhood pre-IPO, and currently offer access to OpenAI, Anthropic, and others.

The Most Important Part: Investment Risks

Investing in private companies is inherently risky. Valuations can plummet, and liquidity is not guaranteed. However, with these platforms, you must consider platform-specific risks, which can be even greater.

Regulatory & Jurisdictional Risk:

Jarsy: This is the highest-risk platform from a regulatory standpoint. Operating from an offshore jurisdiction means you have little to no legal recourse in a major market like the US or Europe if something goes wrong. A regulatory crackdown on RWA tokenization could instantly freeze assets.

Republic & Linqto: Being US-regulated significantly mitigates this risk. They operate under a strict legal framework with clear consequences for fraud or mismanagement.

Custody & Counterparty Risk (The "Rug Pull" or Failure Risk):

Jarsy: This is the platform's biggest vulnerability. Because the underlying shares are held by Jarsy itself or an unnamed entity, you are completely exposed if the platform becomes insolvent, is fraudulent, or is simply mismanaged. You are trusting the platform operators directly.

Republic: The risk is with Republic as your counterparty, as you own a debt instrument from them. However, their regulated status and use of established banking partners for holding funds provide substantial protection compared to an unregulated entity.

Linqto: This model offers the strongest protection. Because the shares are held in a legally separate SPV by a third-party institutional custodian, your investment is bankruptcy-remote from Linqto's own corporate finances. If Linqto were to fail, the custodian would still hold the assets on behalf of the SPV's members.

Asset Authenticity Risk:

Jarsy: You must trust that Jarsy has genuinely acquired the shares they claim to have tokenized. This is verified by their own statements, not by a public regulatory filing.

Republic & Linqto: As regulated entities, they have a legal obligation to ensure the assets they provide access to are authentic. Misrepresenting this would have severe legal consequences.

Conclusion: Who Should Invest, and How?

The democratization of private market investing is a massive step forward, but it's a minefield for the unprepared.

Jarsy is for the high-risk tolerance, crypto-native investor who is comfortable with regulatory ambiguity and platform counterparty risk in exchange for low entry barriers and access for otherwise restricted nationalities. The risk of total loss due to platform failure is highest here.

Republic is a good, regulated entry point for those interested in gaining financial exposure to unicorns without the complexities of direct share ownership. It's suitable for US investors and those who prioritize regulatory oversight over direct asset ownership.

Linqto is the gold standard for accredited investors seeking the safest, most legally robust structure for holding private equity. The use of third-party custodians and SPVs is the closest you can get to the traditional institutional model.

Before you invest a single dollar on any platform, do your own due diligence. Read their legal documents, understand their fee structures, and never invest more than you can afford to lose. The future may be private, but your investment decisions should be made with your eyes wide open.